Tax preparation available at Belmont Ministry Center Thursday to Saturday afternoons through Apr. 13.

Jack C. Massey College of Business students are applying their classroom knowledge and helping recipients of Belmont’s Family Wellbeing Program (FWP) receive tax assistance through the IRS’s Volunteer Income Tax Assistance (VITA) program. VITA provides free basic tax return preparation to qualified individuals while creating an opportunity for them to understand their taxes, and hopefully get a cash return in the process.

FWP offers a variety of wraparound programs, including being a VITA site for the last three years, to low-income families across the Nashville area in collaboration with The Store.

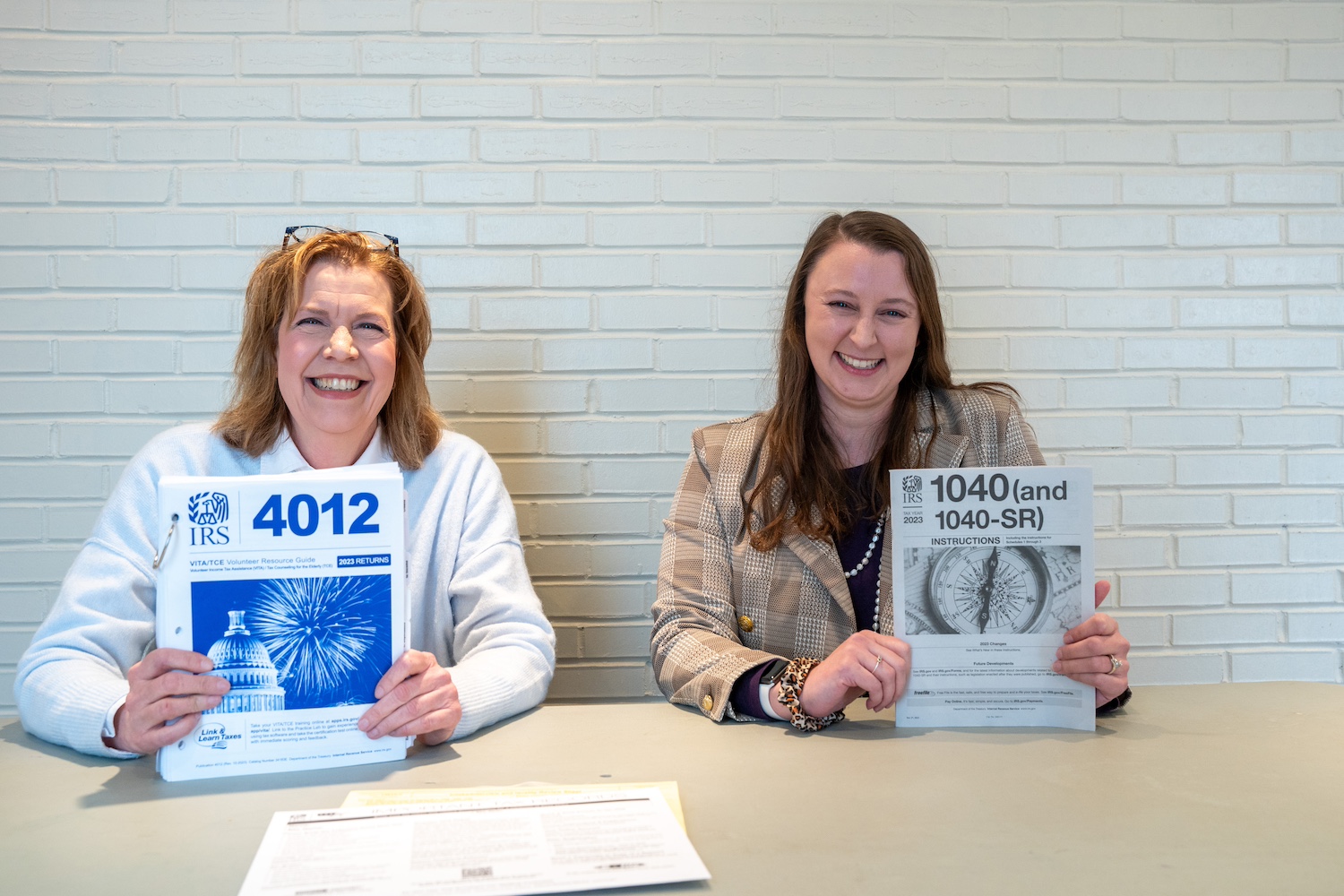

This tax season, Massey Professor of Accounting Dr. Marilyn Young and students are partnering with FWP to provide VITA services.

“[Students] want to use what [they’ve] learned to help solve a problem in the community and serve someone in the community,” Young said. “It is one level of understanding to answer a question on an exam. It is another level of understanding to have to answer a question from a taxpayer that you don't see coming. It's uncomfortable at first, but the more you do it, the better you get. When you can explain it, then you're an expert.”

One master of accountancy student and seven undergraduate accounting students are participating in the program. These aspiring professionals took three certification exams to teach them the ropes and are guided through the process by Young and FWP employees.

“I think a big [motivator] for me is honestly meeting the people here – like Dr. Young,” said sophomore accounting major Emily Fuentes. “I didn't really know much of her until I started actually talking to her. She's already helped me out, just in general.”

“I think a big [motivator] for me is honestly meeting the people here – like Dr. Young,” said sophomore accounting major Emily Fuentes. “I didn't really know much of her until I started actually talking to her. She's already helped me out, just in general.”

Brittany Tolbert, FWP program director, has been working with Young and her students to ensure VITA’s success. “The College of Business has come on board and supported us with student volunteers,” Tolbert said. “It's been wonderful.”

Student volunteers are using their expertise to help their Nashville neighbors. “[My academic advisor] recommended it to me and said it would be a good opportunity to get involved with the community,” said accounting freshman Ephraim Johnson.

The opportunity for Nashville residents to get their taxes done for free means that more people will be able to receive refunds and put money back into the Nashville economy and their own wallets.

VITA’s goal is to empower people with the basic knowledge of how and why they need to file in a certain way.

“When we're sitting down with them, and we're preparing their taxes, we're not doing it in silence,” said Tobert. “We are educating them throughout the process. They’re able to make more educated decisions because they had somebody care and educate them about the process.”

VITA tax services are available to those who generally make $64,000 or less, have disabilities or are limited English speakers. Located at the Belmont Ministry Center (2005 12th Ave. S), VITA is open Thursdays 11a.m. – 4p.m. and Fridays 10a.m. – 3p.m. as well as noon – 3 p.m. on the following Saturdays: Feb. 17, March 2, March 16, April 6 and April 13.

Items to bring:

- Photo ID

- Social security card (personal cards and dependents’ cards)

- Tax forms